2 Introduction

Let’s start with the definition of sustainable finance given by Wikipedia:

“Sustainable finance or green finance is the set of financial regulations, standards, norms and products that pursue an environmental objective, and in particular to facilitate the energy transition.” In some cases, other pillars, such as society, in its broad sense (human rights, inclusiveness), and governance (diversity, inclusiveness, transparency and corruption control) are other important criteria for financial decision making.

The course is divided into two parts, which will shed light on different, yet complementary, facets of green finance.

- The first facet, revolving around corporate finance, deals more with companies adjusting to new paradigms, like climate change, inclusion, and other growing ethical concerns. Green finance will be treated from the inside of companies, with questions such as: how to cope, or handle these new issues, or how to fund green projects.

- The second facet (market finance) focuses on the outside part, by which we mean investors willing to invest in green assets.

In fact, for the latter, there are several closely related concepts:

Truth be told, people are likely to disagree with respect to the differences between these terms, because they are so similar. Often, they serve as synonyms. The common point in all of them is the will to invest in (i.e., finance) projects that will, in a way or another, contribute to higher social and environmental welfare. ESG investors seek to tilt their investment towards assets that are more sustainable, in the sense that they have better ESG metrics (we will cover this in detail in the section on green portfolio choice).

Most of the time, ESG investors hope to win doubly: earning higher returns while at the same time investing responsibly. This is the motto “doing well (for your portfolio) by doing good (for the planet)”. Unfortunately, this is not always or often the case, as things are of course not that easy.

Impact investors, on the other hand, will have a tendency to care much more about the impact of their allocation and overlook, to a certain point, the financial performance. The aim is not to lose money, but, given a modest objective of return (and risk), to invest in the most impactful manner.

An interesting notion here is that of risk. While impact investors are likely to agree to reduce profitability, it’s not clear they accept to take riskier bets. Though it could be the other way around: they might accept more risk, for a similar return. In short, the old-fashioned dilemma between risk and return now integrates a third component: sustainability. We will cover this later on in the Section on sustainability-driven portfolio choice.

2.1 Context

2.1.1 First observation: a growing interest

In the figure below, we plot the relative amount of Google queries (from Google Trends) through time for online searches of the terms:

- CSR (Corporate Social Responsibility) and

- ESG (Environment Social Governance pillars).

\(\rightarrow\) CSR has been here for some time, but the acronym ESG is progressively becoming mainstream in corporate reporting standards and, consequently, in investors’ jargon.

FIGURE 2.1: Online queries of keywords through time: average annual Google Trends metrics for the terms CSR and ESG.

2.1.2 Why? Increased concerns!

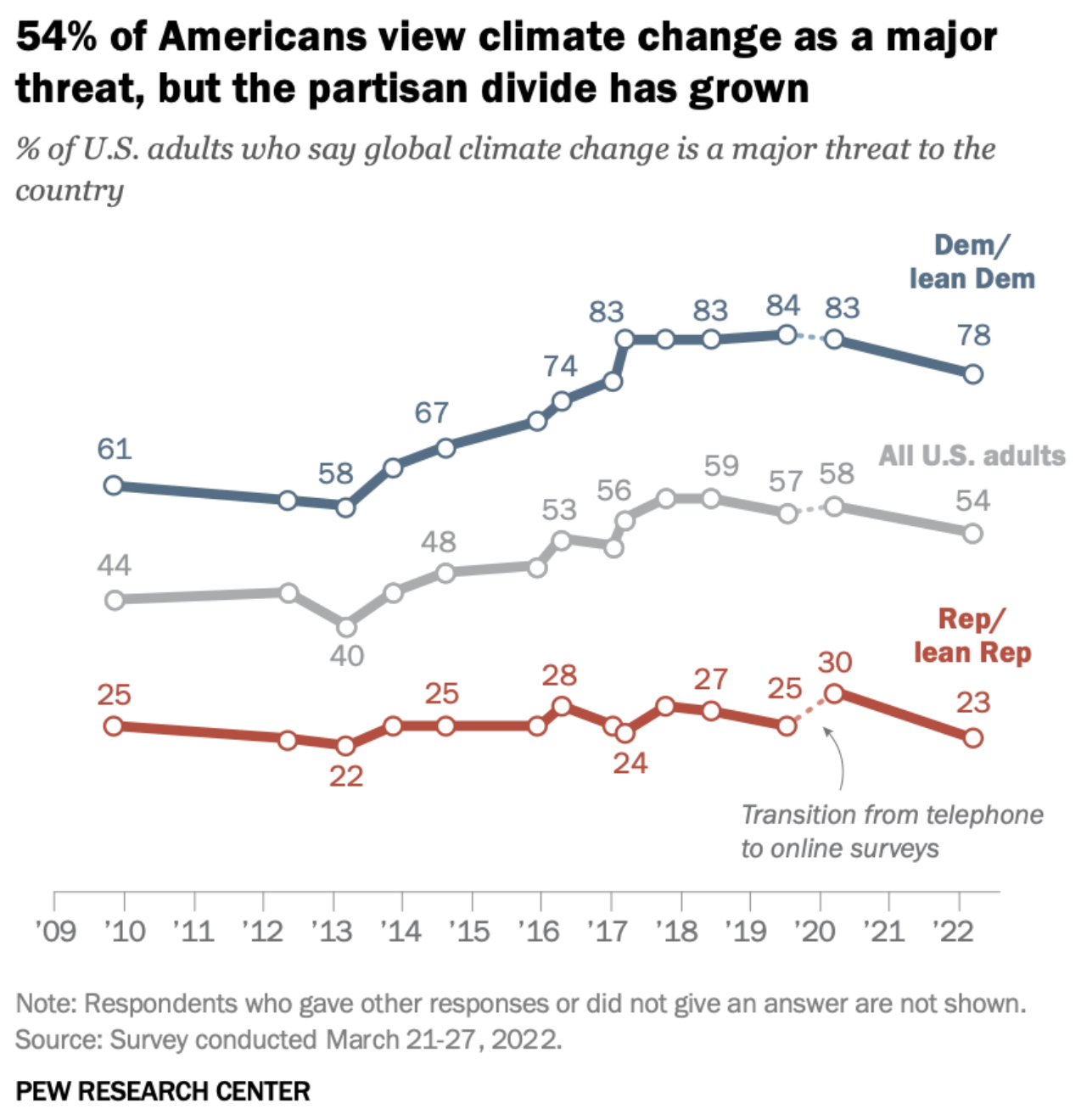

Worldwide surveys show that people are increasingly worried about climate change. Because this in now undoubtedly linked to human footprint (more on that later), there is an urgent need to act. (SIDE NOTE: from a financial standpoint, we will later see that asset returns may be linked to concerns, see Dissecting Green Returns, public version here.)

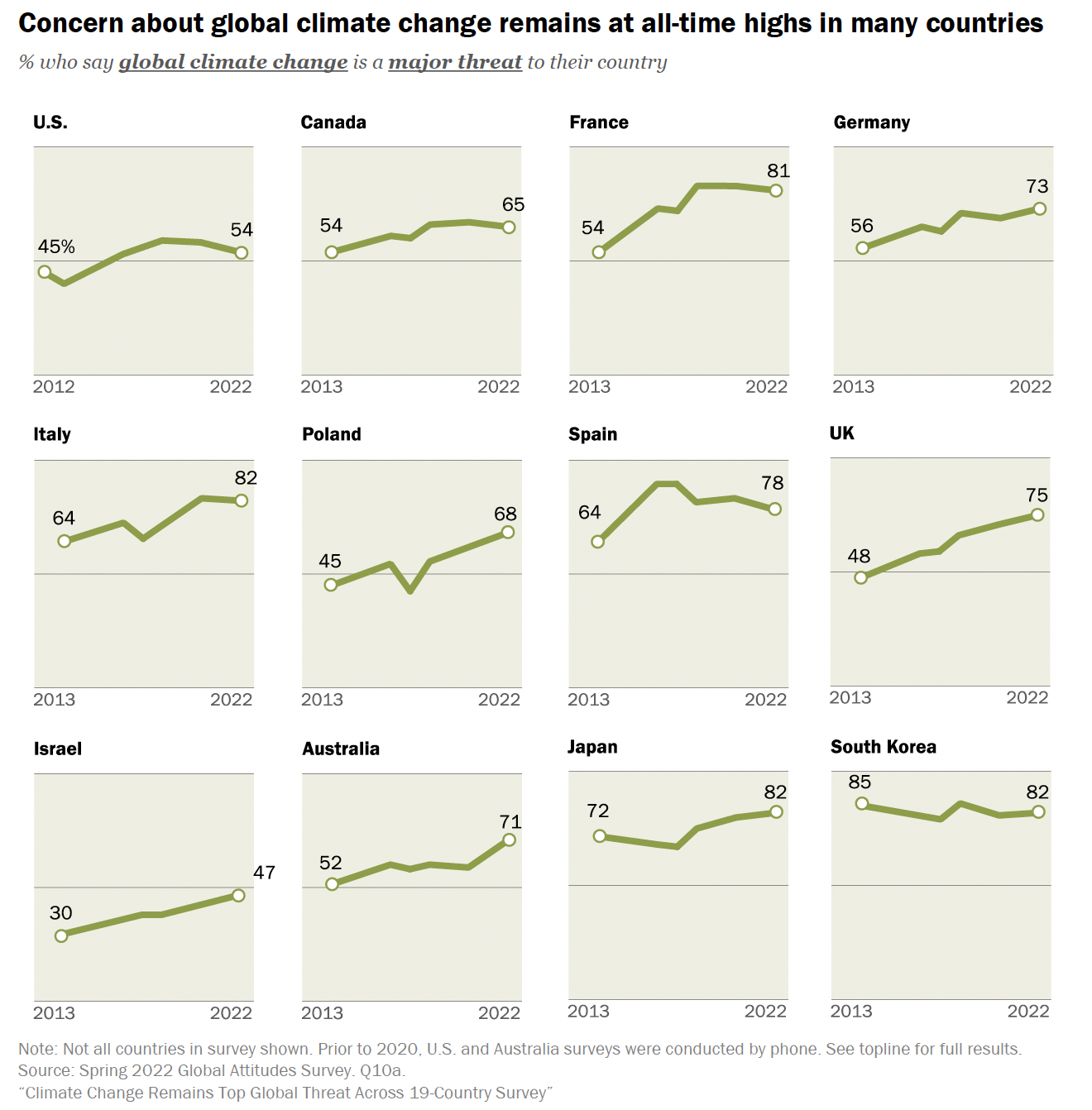

First, data from the Pew Research Center, based in the US. The study is from late 2022.

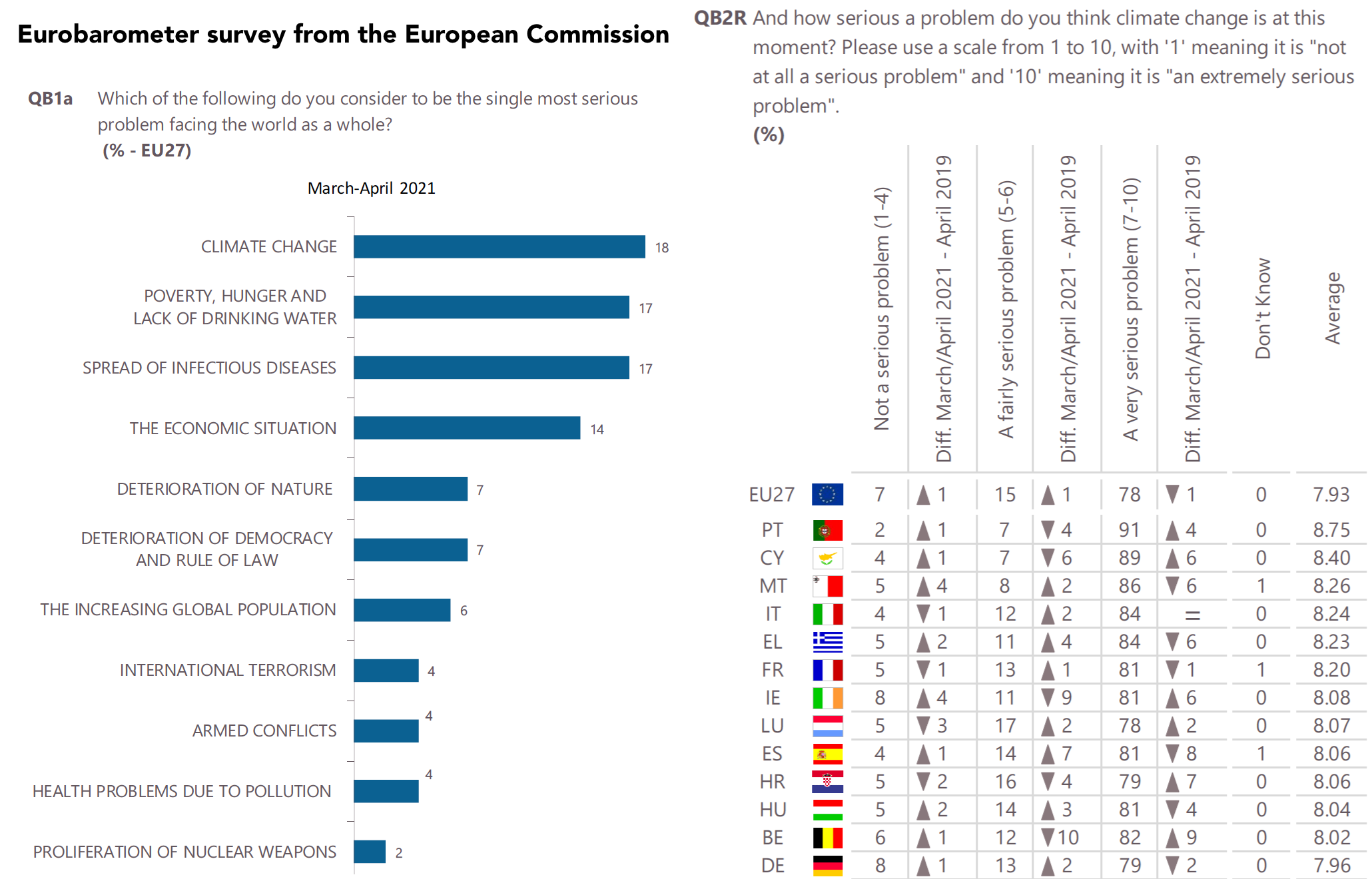

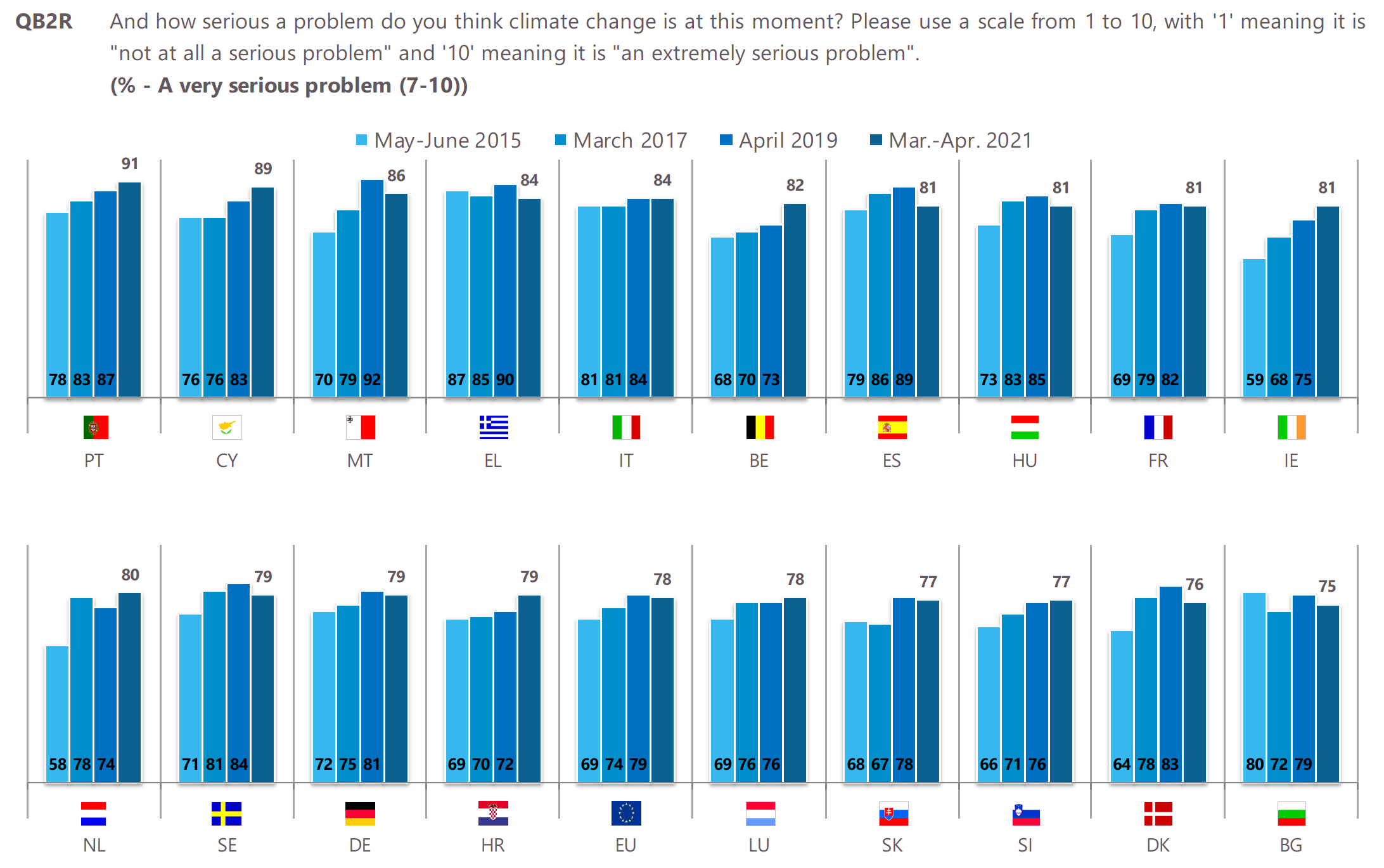

Next, similar results from the European Union. They come from the EuroBarometer, which is a batch of surveys carried out in the EU every two years.

The dynamic is interesting. Indeed, because the survey is carried out regularly, we have more than a single snapshot.

Beliefs regarding climate change can depend a lot on political views…

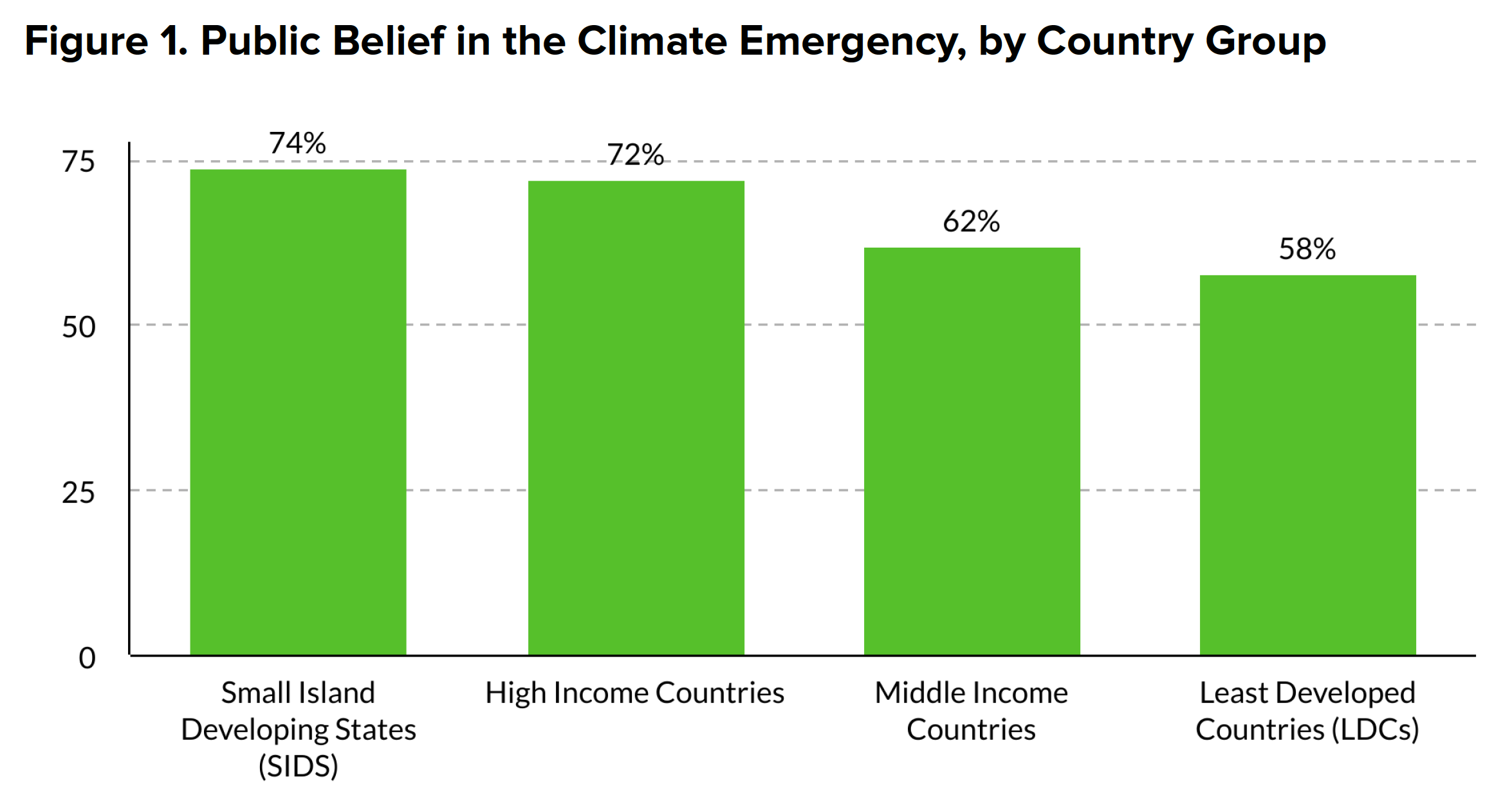

Finally, polls from the Oxford - United Nations Development Programme (UNDP) Peoples’ Climate Vote initiative show discrepancies between regions.

NOTE: examples of SDIS include the Bahamas, Micronesia, Guyana, Jamaica, Fidji, Samoa, Maldives & Singapour. For a full list, see Wikipedia. It is clear and logical that those who have the most to lose are the most concerned.

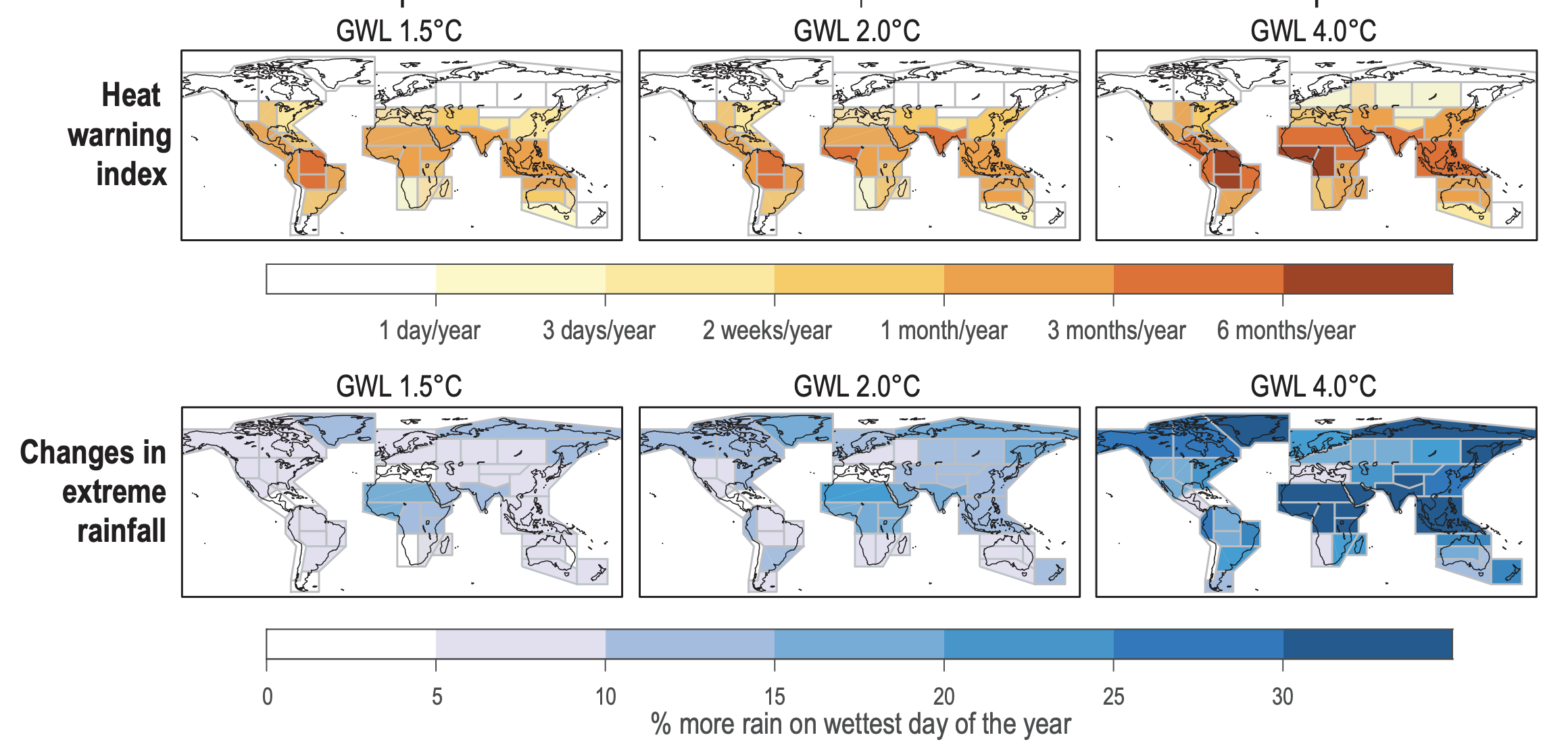

In fact, as is well-known and already mentioned in expert reports, some countries (or areas) may even benefit from global warming - up to a certain point. Ex: Canada, Russia. Though, as the 2021 AR1 IPCC reports show, temperature is not the only important indicator:

Rain also matters!

SIDE NOTE:

When people are concerned, what can they do to improve (i.e. curtain) their environmental footprint?

-

reduce consumption: fewer products, less energy (heating), less travelling.

-

change consumption: use electric cars, eat local food, buy second-hand clothes & phones.

-

change habits: go to work by bike, or use public transportation, recycle more, resort to composting.

-

try to change corporate practices: basically all of the above, but at the workplace (easier to impose or propose when in managerial position).

-

vote for environment-friendly parties? => to increase the odds of public measures.

- care about savings / investments: make sure your money benefits causes & initiatives you care about.

2.1.3 Hence, growing demand

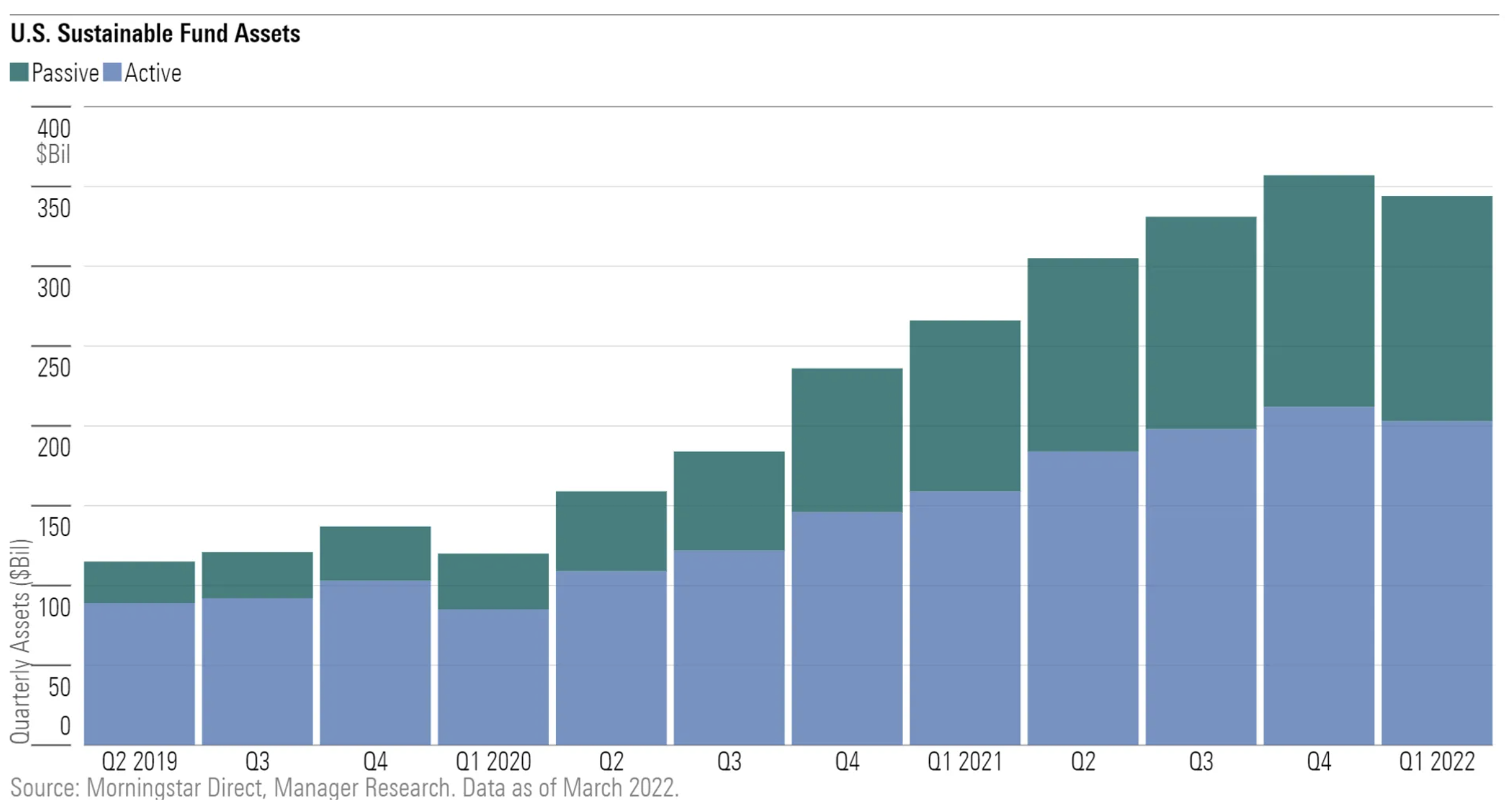

At the aggregate level, we can track the amount of money invested in so-called “green” funds. This is complicated because all funds have very different ways of being green. In 2022, Morningstar removed the ESG label of 1,200 funds.

Moreover, trends tend to be somewhat different from one region to another (e.g., US versus Europe or Asia).

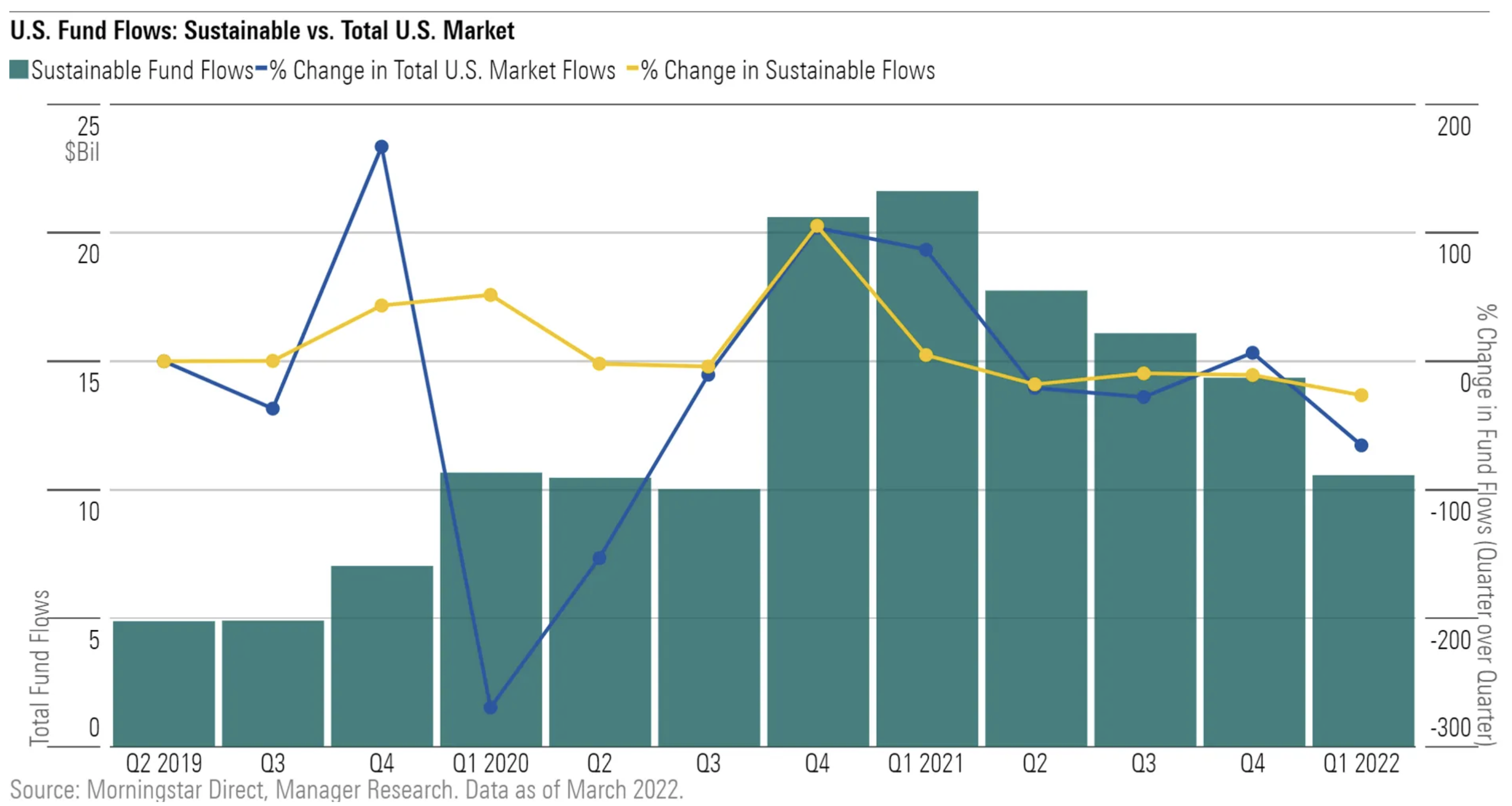

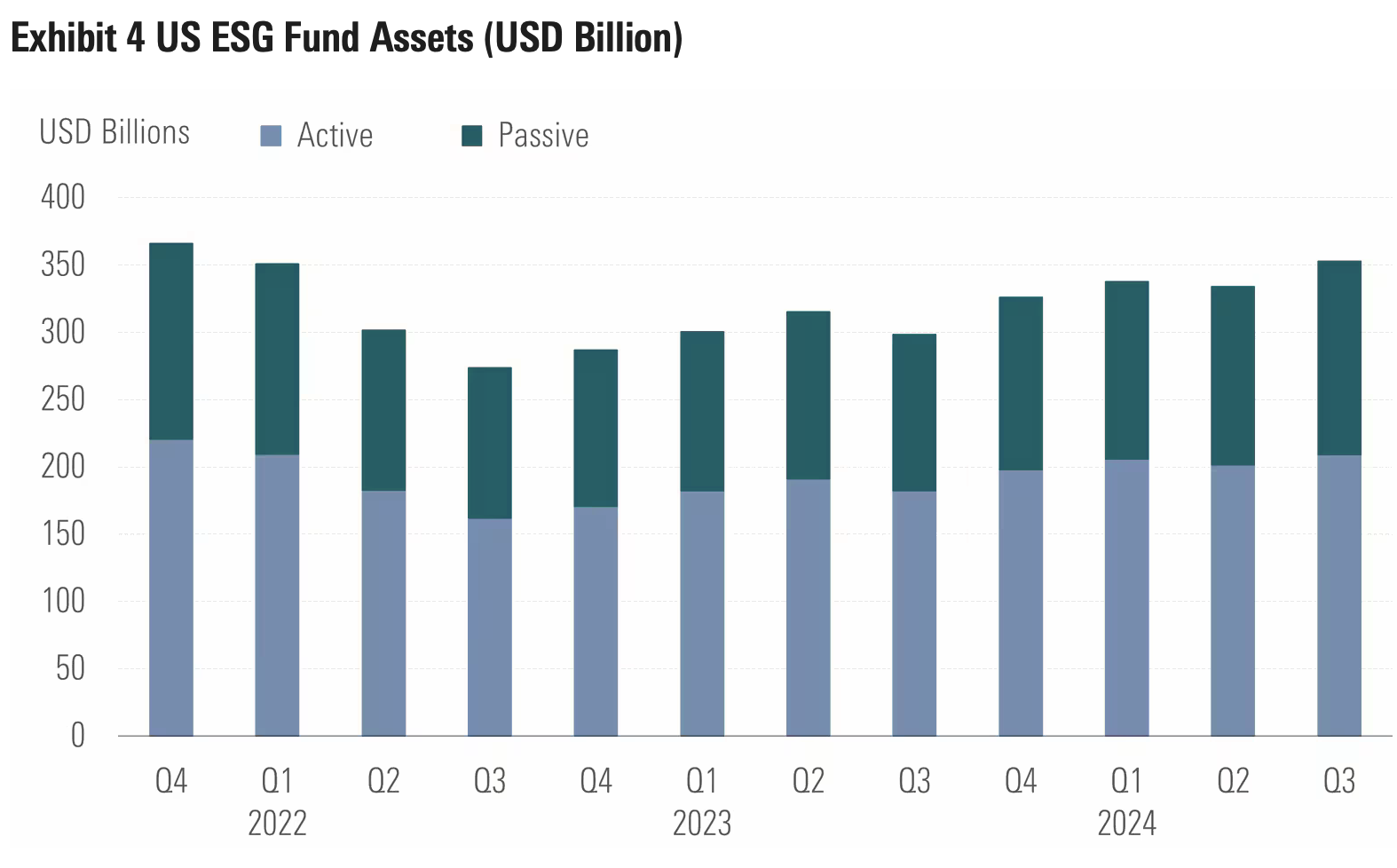

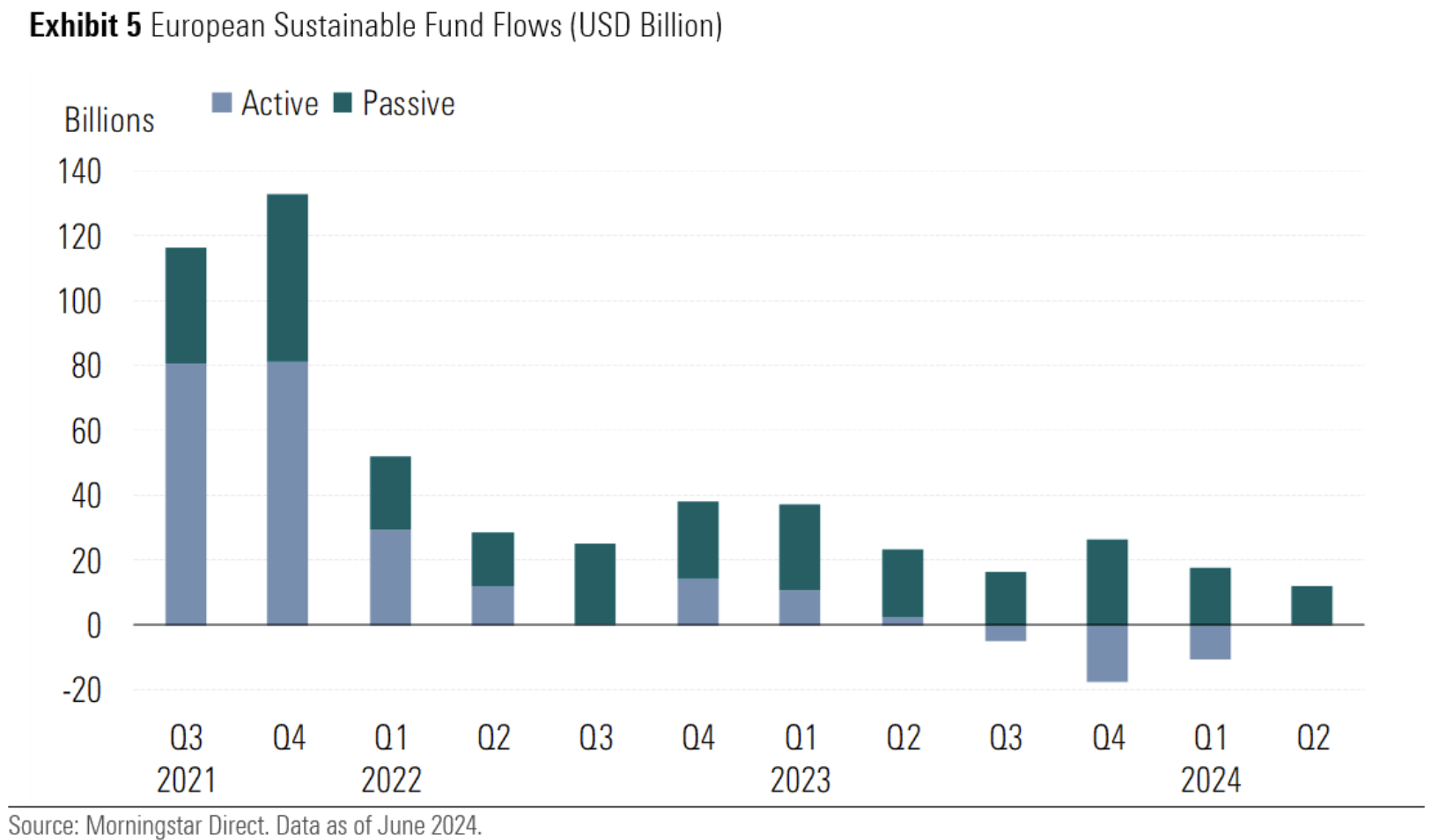

For instance, let us have a look at some Morningstar data. Given the providers’ classification (none is perfect), it plot shows the amount of money invested in “green funds”.

In the above graph, a distinction is made between two types of investment styles:

-

active investing in which a money manager makes granular (e.g., stock-by-stock and/or bond-by-bond) bets relatively often - the portfolio is rebalanced regularly, for instance every month.

- passive investing; in this case, the money manager buys a index and follows the market. Passive investing in traditional finance often refers to buying indices like the Dow Jones, the S&P500, the Eurostoxx, or the CAC40. Technically, this can be done via exchange traded funds, ETFs. In sustainable finance, such solutions also exist, like the iShares MSCI USA ESG Select ETF in the equity space.

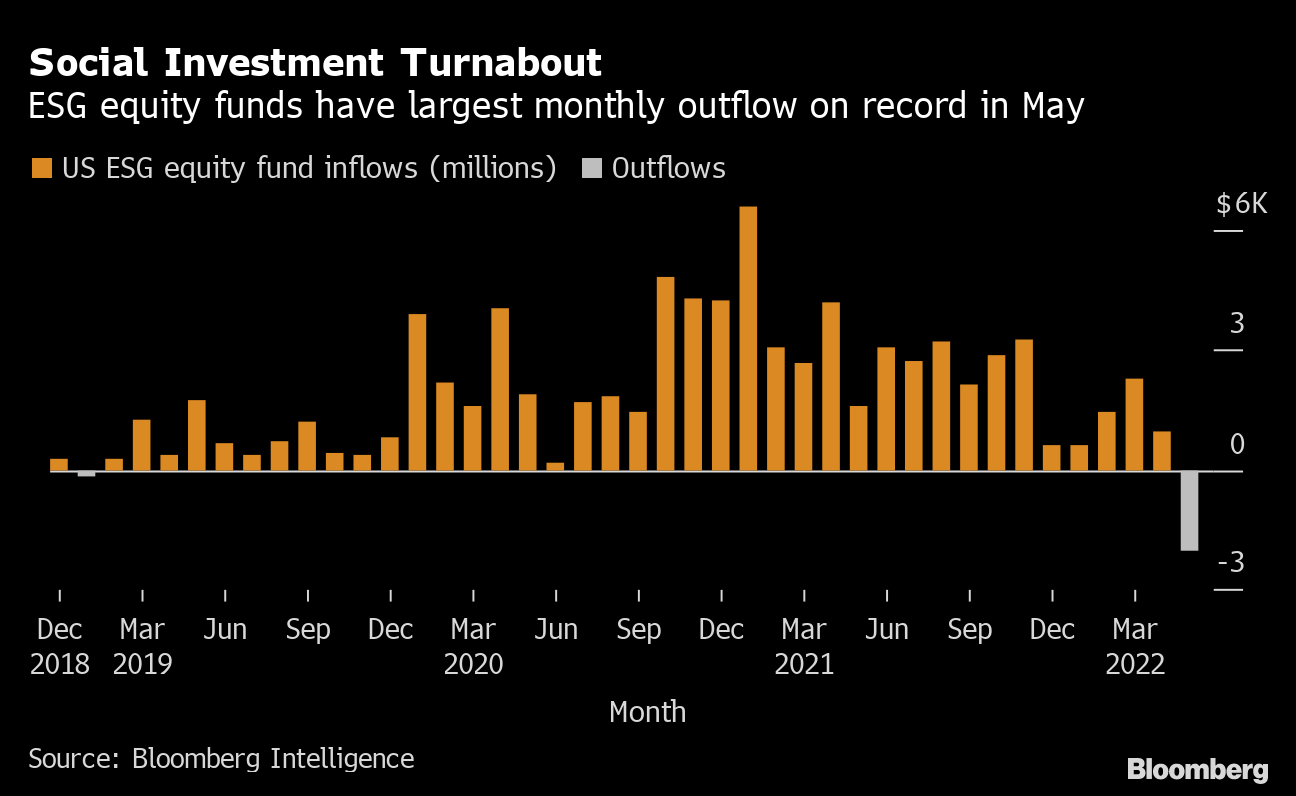

In the US, there are other types of figures, for example from Bloomberg:

There is a major difference between this graph and the previous one. This graph shows flows, i.e., changes.

This is why values can be negative. A negative value means that investors have removed (withdrawn) their assets from the fund in excess to positive flows to the fund.

It is crucial to understand the difference between raw fund values and fund flows.

A big question is: why the sudden drop in May 2022?

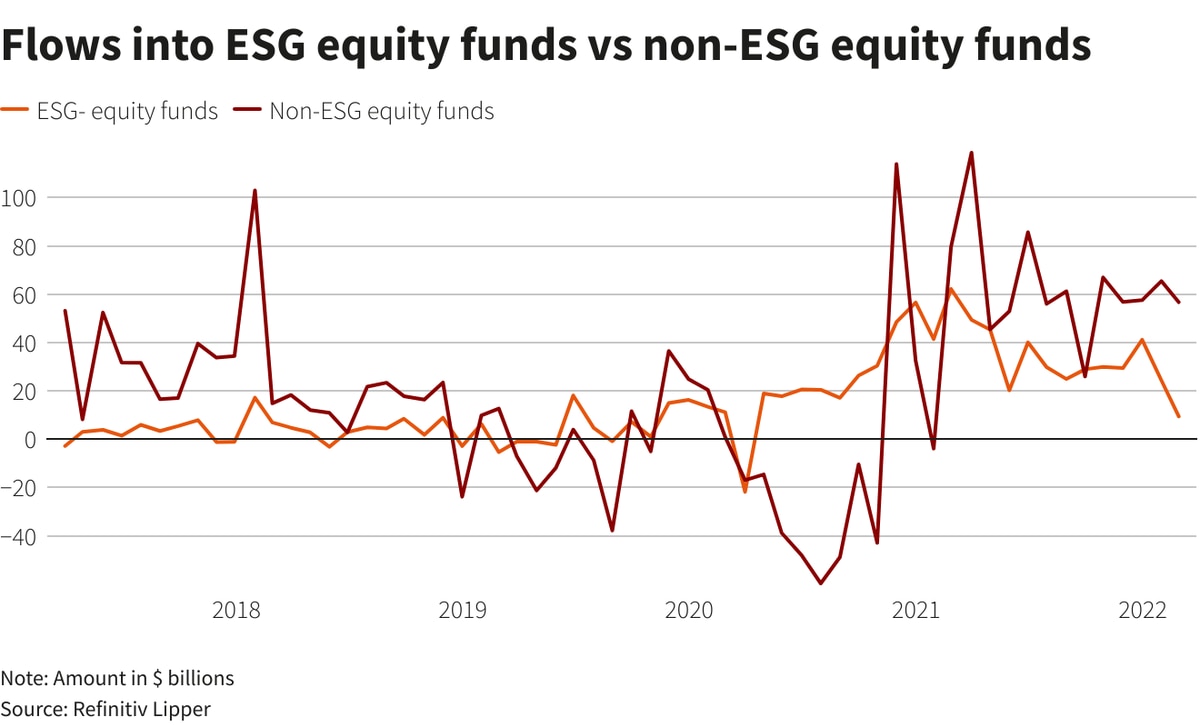

Another similar plot is provided by Refinitiv:

Unfortunately, this figure does not specify the geographical zone. By default, we could infer that the values hold worldwide. Another way to confirm this intuition is to compare the scales/magnitude with the above graph. Since values are much higher, it is likely that they encompass all markets.

Now let’s come back to Morningstar… in order to underline some subtleties and possible inaccuracies.

First, in the graph, flows (green bars) are all positive, but they decrease towards the end. This should mean that total assets continue to rise, which is not the case in the last bar of the previous Morningstar graph.

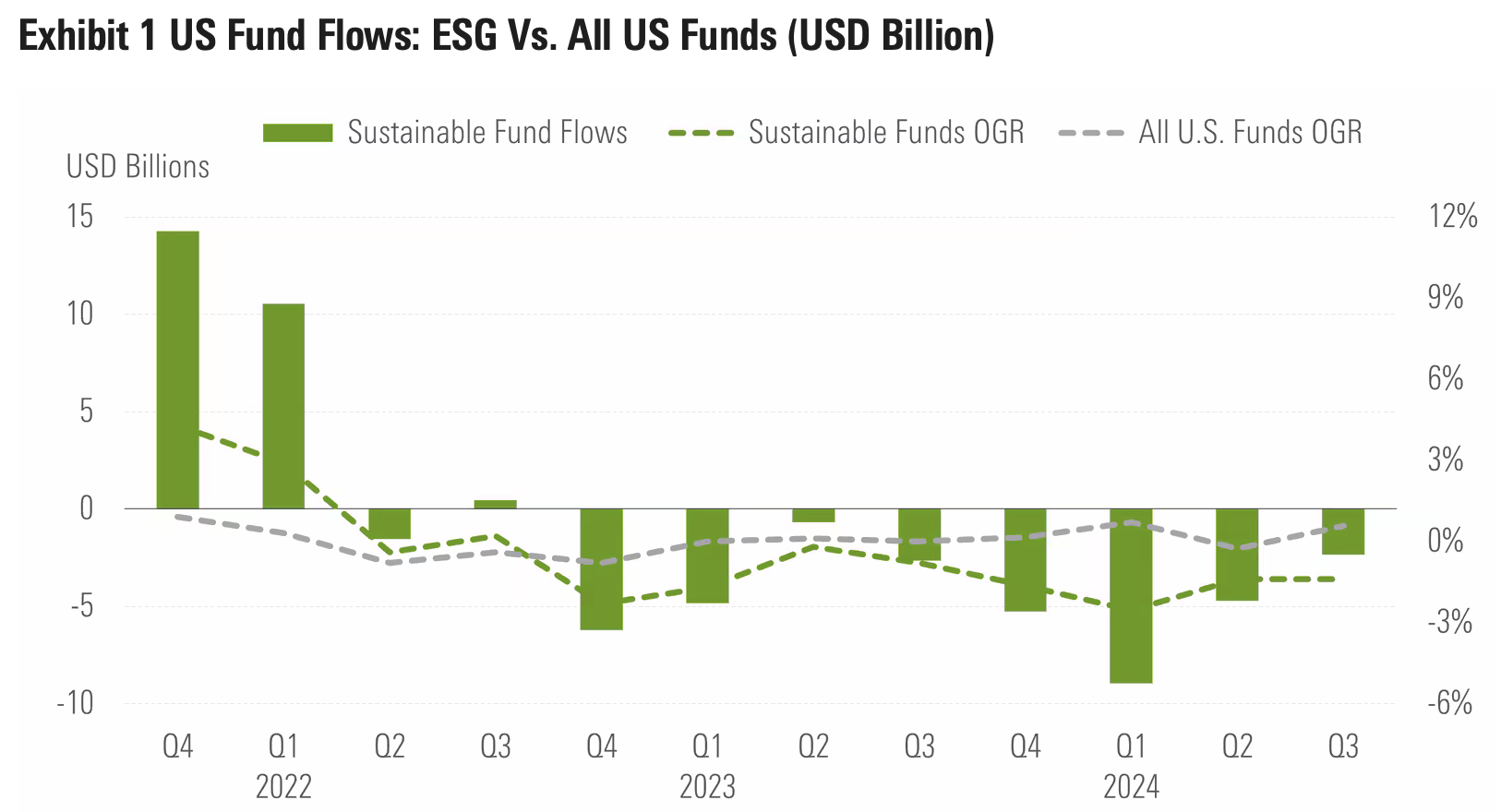

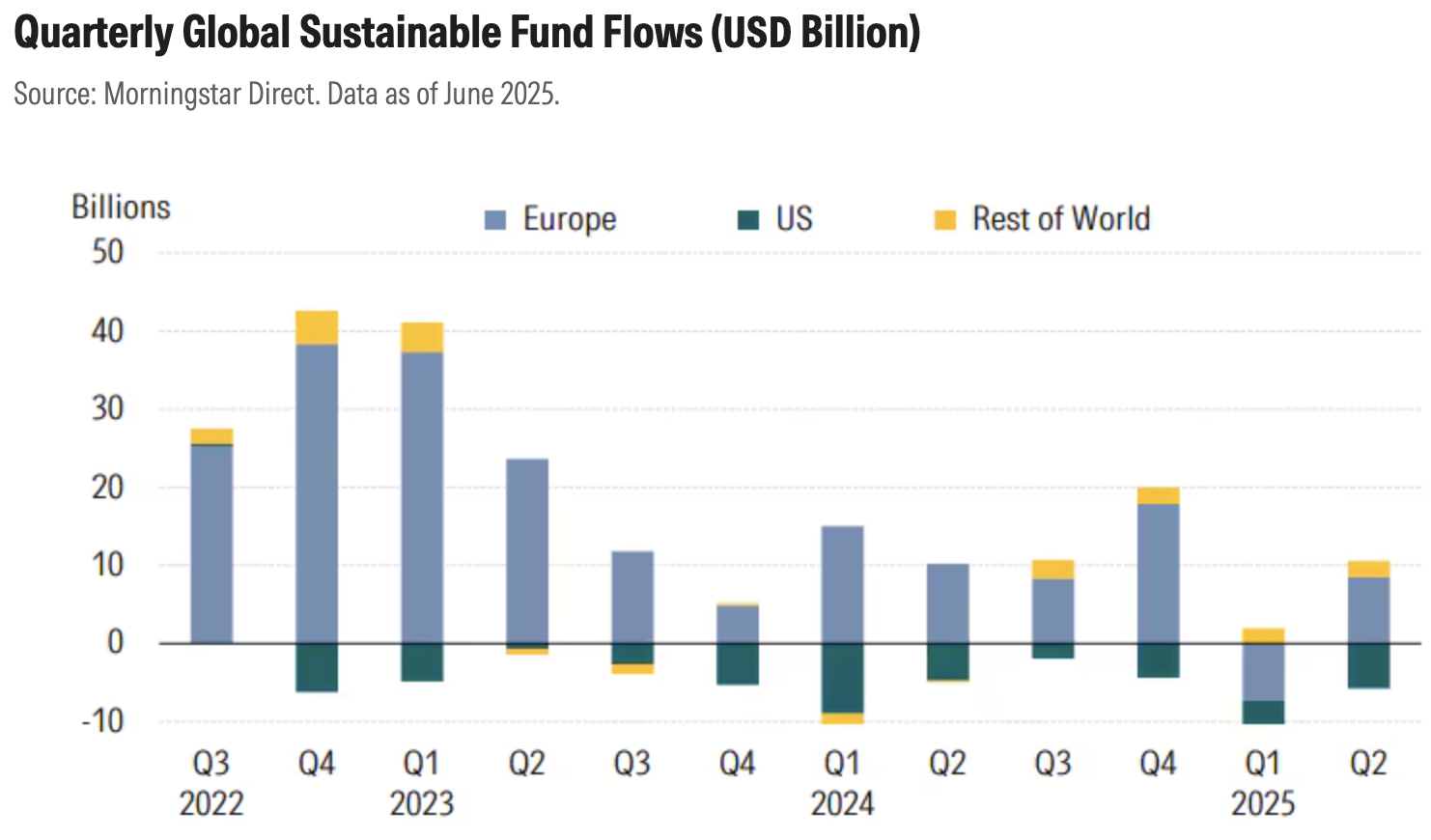

2.1.4 What happened after 2022?

Flows decreased… in the US!

But assets increased - how is that possible?

In Europe, the picture is more nuanced.

But bottomline: ESG is less trendy/hype and in demand than in 2020-2021.

2.1.5 Appetite among students in business schools

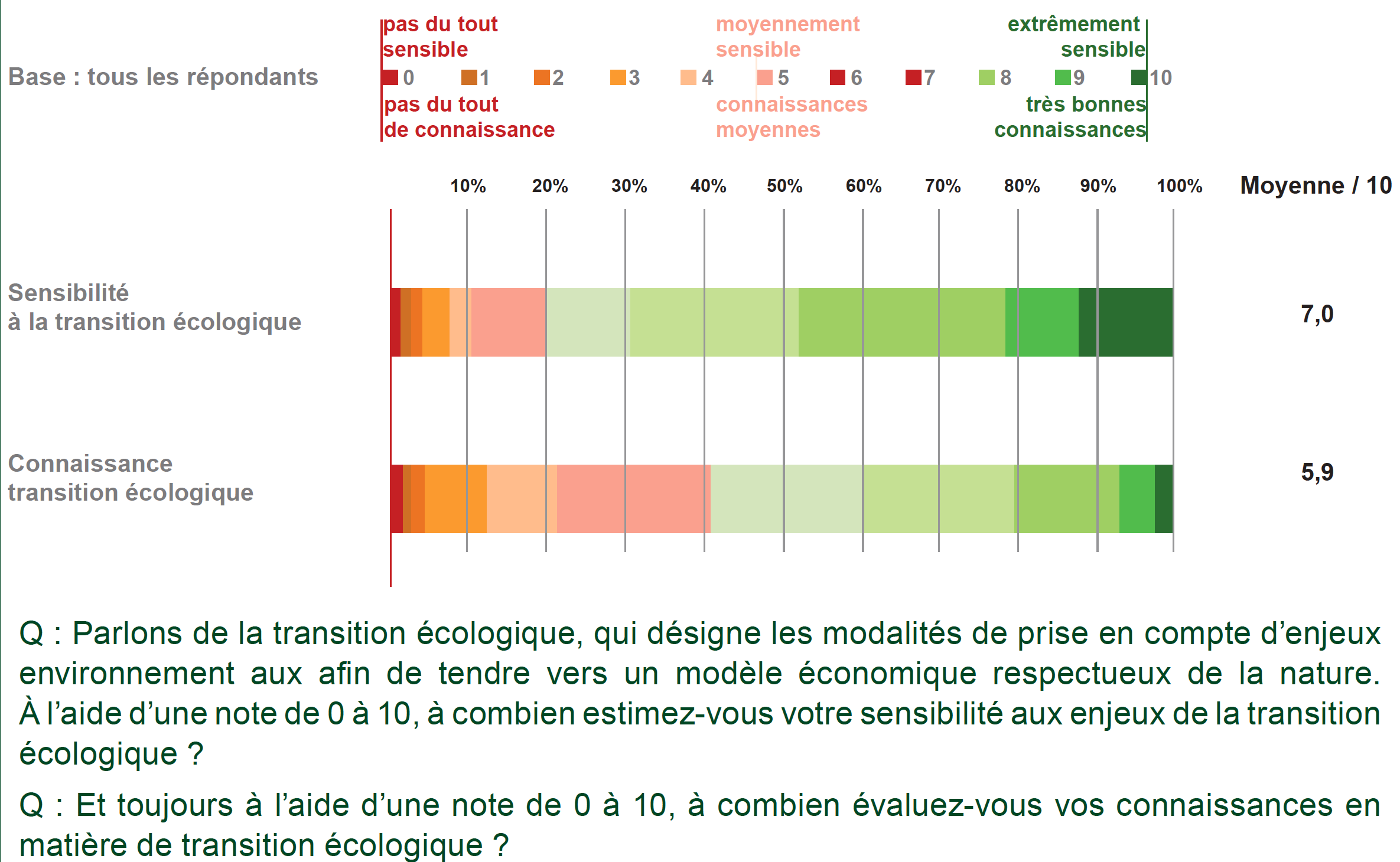

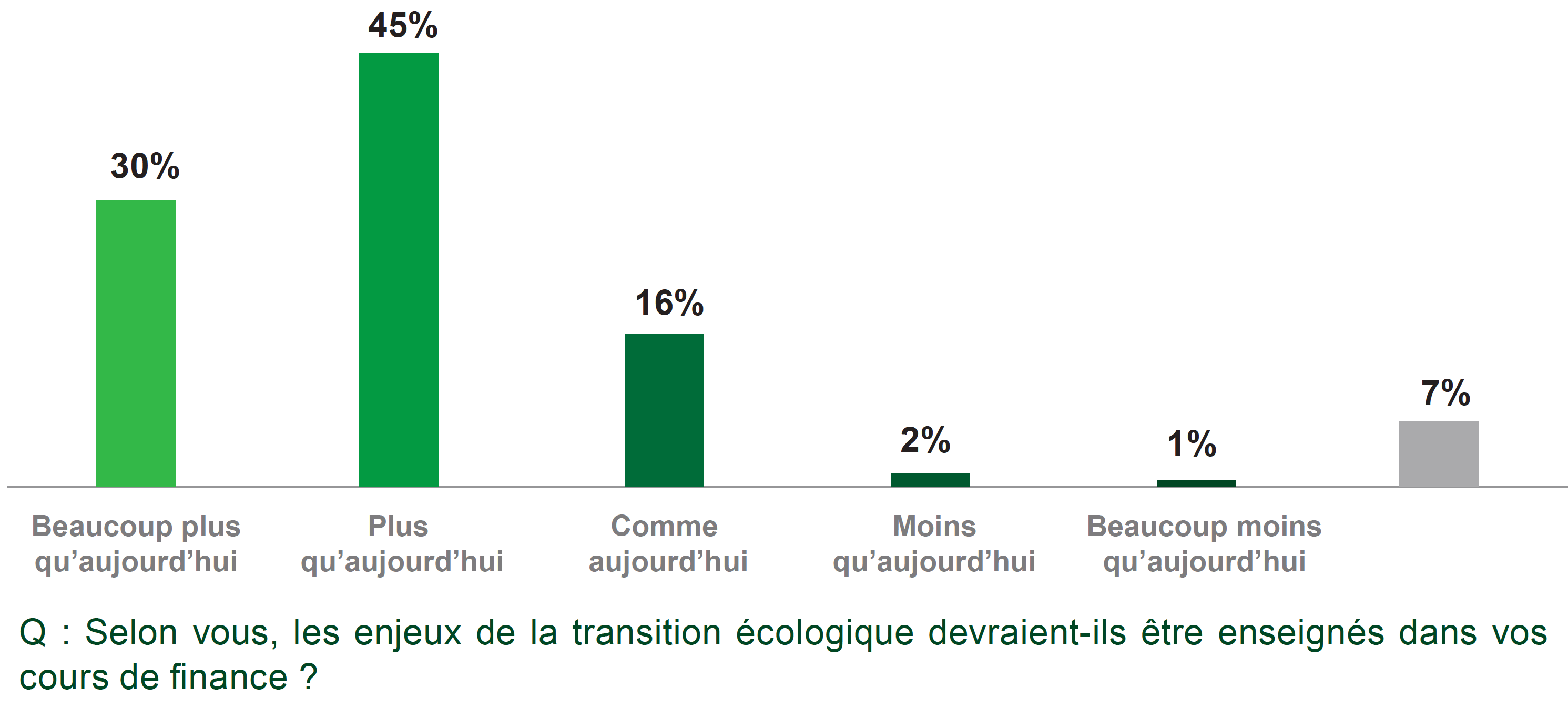

In parallel, demand for sustainability-orientated finance courses is growing. The WWF and French organization Pour un éveil écologique have compiled a survey on the students’ perception of green finance in 9 French business schools. They report the following results:

The first horizontal bar represents the interest in the climate transition among students. We see that 20% are not very sensitive to this subject, but 30% are somewhat sensitive and 50% very sensitive. The second bar depicts knowledge and competence on the matter. It shows that 50% have limited knowledge, while 20% have very good (darker green) understanding of the topic. Hence, there is a small disconnect between interest in climate transition and knowledgeability on the topic, which creates appetite for courses on green finance:

75% of respondents ask for more climate-related content in finance courses. 3% only ask for less.

Therefore, the appetite towards courses in green finance is substantial: hence the present material!

2.2 Jargon

One entry cost with sustainability is the amount of acronyms, technical terms, organisations, labels, and parlance that are commonly used. For instance, acronyms (the list is not exhaustive):

| Acronym | Meaning | Information |

|---|---|---|

| BSR | Business for Social Responsibility | A group of experts and firms dedicated to building a sustainable world. |

| CDP | Carbon Disclosure Project | A not-for-profit charity that helps investors, companies, cities, regions to manage their environmental impacts. |

| CDSB | Climate Disclosure Standards Board | An international consortium of business and environmental NGOs. |

| CSRD / NFRD | Corporate Sustainability Reporting Directive / Non-Financial Reporting Directive | A European directive that applies to large firms. The CSRD replaced the NFRD. |

| GRI | Global Reporting Initiative | An international independent standards organization that helps businesses and governments understand and communicate on their ESG impacts. |

| IIGCC | Institutional Investors Group on Climate Change | A European membership body for investor collaboration on climate change. |

| IIRC | International Integrated Reporting Council | A global coalition that advocates sustainable goals for corporate reporting. |

| ISSB | International Sustainability Standard Board | Independent standard-setting body. |

| SASB | Sustainability Accounting Standards Board | A non-profit organization that seeks to develop sustainability accounting standards. |

| SDG | Sustainable Development Goals | A blueprint from the United Nations (UN) to achieve a better and more sustainable future for all. |

| SFDR | Sustainable Finance Disclosure Regulation | A set of EU rules which aim to make the sustainability profile of funds more transparent and comparable. |

| TFCD | Task Force on Climate-Related Financial Disclosures | A group that develops recommendations for more effective climate-related disclosures. |

| TNFD | Taskforce on Nature-related Financial Disclosures | Like TFCD but for biodiversity. |

| UNEPFI | United Nations Environment Programme Finance Initiative | A partnership between United Nations Environment Program (UNEP) and the global financial sector to mobilize it toward sustainable development. |

| UNGC | United Nations Global Compact | A voluntary initiative based on CEO commitments to implement universal sustainability principles. |

| UNPRI | United Nations Principles for Responsible Investment | An international network of investors working together to implement its six aspirational “Principles” (see below) |

The six principle of the UNPRI:

- To incorporate ESG issues into investment analysis and decision-making processes.

- To be active owners and incorporate ESG issues into ownership policies and practices.

- To seek appropriate disclosure on ESG issues by the entities in which they invest.

- To promote acceptance and implementation of the Principles within the investment industry.

- To work to enhance their effectiveness in implementing the Principles.

- To report on their activities and progress towards implementing the Principles.

2.3 Actors

2.3.1 Schematic view

Basically, it’s all summed up in the diagram below.

We will come back to that in the section on climate-based economic models.

2.3.2 Finance solutions for retail investors (with a focus on France)

It is important to note that there are more and more smaller initiatives and start-ups that seek to propose green investments for those who care about the impact of their savings. There are several ways to do so in France, as the green finance ecosystem is expanding:

- green savings accounts: livret de développement durable et solidaire (LDDS), livret d’épargne populaire (LEP), livret NEF

-

standard savings media, like life insurance, or the French plan d’épargne en actions (PEA), can be certified by green labels (e.g., Greefin, which is given by third party certification firms, such as Afnor, EY France and Novethic).

- green crowdfunding platforms: Miimosa, Lita, Wiseed, Zeste, Lumo (like Enerfip, for green energy projects), WeDoGood (via royalties), Blue Bees (for agricultural & rural projects).

In addition to those mentioned above, we can add a few services that operate in France (at least):

- the so-called “green banks”: Hélios, OnlyOne, Green Got, Bunq (one offer in particular), La Nef. It’s hard to grasp the sincerity of their commitment.

- investing & saving services: Goodvest and Moka.

- a few traditional banks that are tilted toward green objectives: Crédit Coopératif and Banque Postale (in France).

More generally, new products have emerged worldwide, such as:

-

green bonds are bonds issued to finance green projects (e.g., that have social or environmental benefits: renewable energy infrastructure, energy-efficient buildings, clean transportation, waste management, recycling, etc.). Portfolios of such bonds can be packaged in tradeable funds, and many have quotes on Yahoo Finance, see here.

- green equity trackers (Equity Traded Funds): it’s impossible for retail investors to invest in many green stocks to obtain sufficient diversification. ETFs are here to help. However, the rules that set the portfolio composition are often opaque. ESG comes in many flavours…

We will zoom on the latter later in the course.